The SYD function is a built-in function in Excel that is categorized as a Financial Function. It can be used as a worksheet function (WS) and a VBA function (VBA) in Excel. As a worksheet function, the SYD function can be entered as part of a formula in a cell of a worksheet. SYD VDB Summary The Excel DDB function returns the depreciation of an asset for a given period using the double-declining balance method or another method you specify by changing the factor argument. Purpose Depreciation - double-declining Return value Depreciation in given period Arguments cost - Initial cost of asset.

H m SYD trong Excel c ph p v c ch s d ng

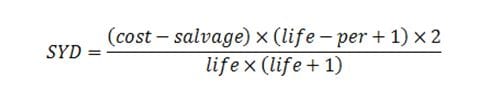

The SYD function in Microsoft® Excel is used to calculate the sum-of-years' digits depreciation for a specified period in the lifetime of an asset. Want to use the SYD function in. The Excel SYD function calculates the sum-of-years' digits depreciation for a specified period in the lifetime of an asset. The syntax of the function is: SYD ( cost, salvage, life, per ) where the function arguments are as follows: SYD Function Example

2. Use of SYD Function in Excel Formula to Calculate MACRS Depreciation. Now, our goal is to create depreciation by using the SYD formula in Excel. Assets do not depreciate linearly over time. The number of depreciation changes every year. To consider this fact, Excel has the built-in SYD function to calculate depreciation. The steps of this. Artikel ini menguraikan sintaks rumus dan penggunaan fungsi SYD di Microsoft Excel. Deskripsi Mengembalikan jumlah dari depresiasi digit tahun dari aset untuk periode tertentu. Sintaks SYD (cost, salvage, life, per) Sintaks fungsi SYD memiliki argumen berikut: Cost Diperlukan. Biaya awal aset. Salvage Diperlukan.

How to Calculate Depreciation In Excel SLN SYD DDB Functions

The Excel SLN function returns the depreciation of an asset for one period, calculated with a straight-line method. The calculated depreciation is based on initial asset cost, salvage value, and the number of periods over which the asset is depreciated. For example, for an asset with an initial cost of $10,000, a useful life of 5 years, and a. The SYD function calculates the depreciation of an asset for a given period based on the sum-of-years' digits depreciation method. Syntax =SYD (cost, salvage, life, per) Arguments cost (required): The initial cost of the asset. salvage (required): The value of the asset at the end of the depreciation.

Sum of the Years' Digits (SYD) To calculate the depreciation using the sum of the years' digits (SYD) method, Excel calculates a fraction by which the fixed asset should be depreciated, using. Parameters. Cost - the initial cost of the asset. Salvage - the value at the end of the depreciation (sometimes called the salvage value of the asset). Life - the number of periods over which the asset is depreciated (sometimes called the useful life of the asset). Per - the period and must use the same units as life.

Excel Depreciation Methods Compared

The SYD function returns depreciation decline amount by taking sum of years data for the specific product. Syntax: =SYD (cost, salvage, life, period) Cost : Cost price of the asset Salvage : remaining price of the asset after its lifetime period Life : period after which cost price becomes salvage price This article describes the formula syntax and usage of the DB function in Microsoft Excel. Description. Returns the depreciation of an asset for a specified period using the fixed-declining balance method. Syntax. DB(cost, salvage, life, period, [month]) The DB function syntax has the following arguments: Cost Required. The initial cost of the.

SYD is an Excel function that calculates the depreciation expense under the sum of the years digits method. Sum of years digits is an accelerated depreciation method, i.e. it charges higher depreciation in initial years of the asset and the depreciation expense declines over time. The SLN Function in Excel is employed to return the sum of years, digits depreciation of an asset for a specified period. Syntax =SYD (cost, salvage, life, per) Parameter Cost - Assest's cost at initial. (Required) Salvage - The value of the asset at the end of the description. (Required)

EXCEL AMORTIZATION AND THE SYD FUNCTION

SLN (cost, salvage, life) The SLN function syntax has the following arguments: Cost Required. The initial cost of the asset. Salvage Required. The value at the end of the depreciation (sometimes called the salvage value of the asset). Life Required. The number of periods over which the asset is depreciated (sometimes called the useful life of. The SYD Formula in Excel is a useful function to calculate depreciation over time. It involves utilizing the SUM, AVERAGE, MIN and MAX functions to determine data and make calculations. In the following table, we have used actual data to demonstrate how each of these functions can be applied professionally: